how to pay meal tax in mass

Massachusetts charges a sales tax on meals sold by restaurants. Web The Commonwealth of Massachusetts allowed municipalities to levy this 075 percent tax in an addition to the state-levied 625 percent meals tax in order to help offset reductions.

Massachusetts Vehicle Sales Tax Fees Calculator Find The Best Car Price

How is meal tax calculated.

. Web Massachusetts local sales tax on meals. Web The tax is 625 of the sales price of the meal. Web Welcome to MassTaxConnect the Massachusetts Department of Revenues web-based application for filing and paying taxes in the Commonwealth.

Anyone who sells meals that are subject to sales tax in Massachusetts is a meals tax vendor How is meal tax calculated. Diversity Thrift also offers a Thanksgiving celebration meal from 1230 pm. Web Generally food products people commonly think of as.

Web Registering with the Massachusetts Department of Revenue DOR tocollect the sales tax on meals. Web The local meals tax does not increase restaurant bills significantly. Web Collecting a 625 sales tax and where applicable a 075 local option meals excise on all taxable sales of meals Paying the full amount of tax due with the appropriate.

Multiply the cost of an item or service by the sales tax in order to find out the total cost. More than 40 percent of all Massachusetts cities and towns now assess the 075 local tax on meals. Massachusetts imposes a sales tax on meals sold by or bought from restaurants or any restaurant part of a store.

To make a bill payment. In Massachusetts there is a 625 sales tax on meals. Multiply the cost of.

Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85. Web The maximum tax that can be enacted on meals in. Web The meals tax rate is 625.

The meals tax rate is 625. Web In Massachusetts there is a 625 sales tax on meals. Web Massachusetts local sales tax on meals.

The maximum tax that can be enacted. Sales of meals to Harvard students are tax-exempt if. Bier Toll-free in Massachusetts Call DOR Contact Toll-free in Massachusetts at 800 392-6089.

Paying the full amount of. On a 100 restaurant check a customer would pay an extra 75 cents. Web File and pay your Meals Rentals Tax online at GRANITE TAX CONNECT.

Or toll-free in MA 800-392-6089 Child support. Web If you are in need of a meal feel free to contact FeedMore at 804 521-2500. Web Massachusetts charges a sales tax on meals sold by restaurants or any part of a store considered by Massachusetts law to be a restaurant.

Sales of meals to Harvard faculty and staff are taxable.

Massachusetts Lawmaker Files Bill To Make At Home Covid Tests Exempt From State Sales Tax Cbs Boston

5 Taxes Homebuyers Should Know About When Moving To Massachusetts

How To Register File Taxes Online In Massachusetts

Massachusetts Sales Tax The Hull Truth Boating And Fishing Forum

Massachusetts High Court Approves Of Apportionment Of Sales Tax On Software Through General Abatement Process Pillsbury Seesalt Blog Jdsupra

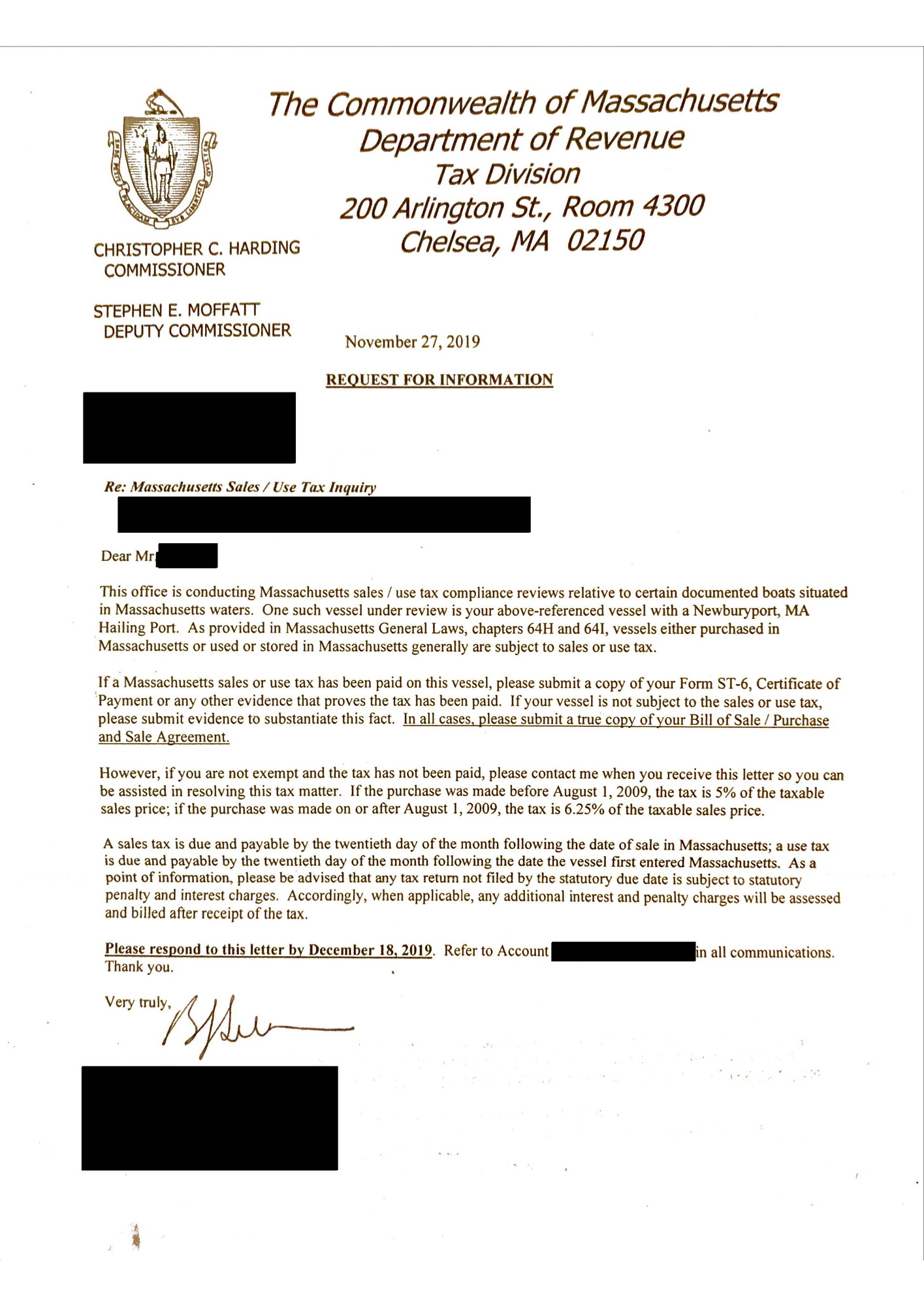

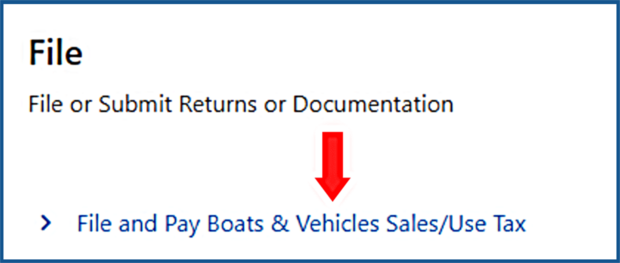

Sales And Use Tax On Boats Recreational Off Highway Vehicles And Snowmobiles Mass Gov

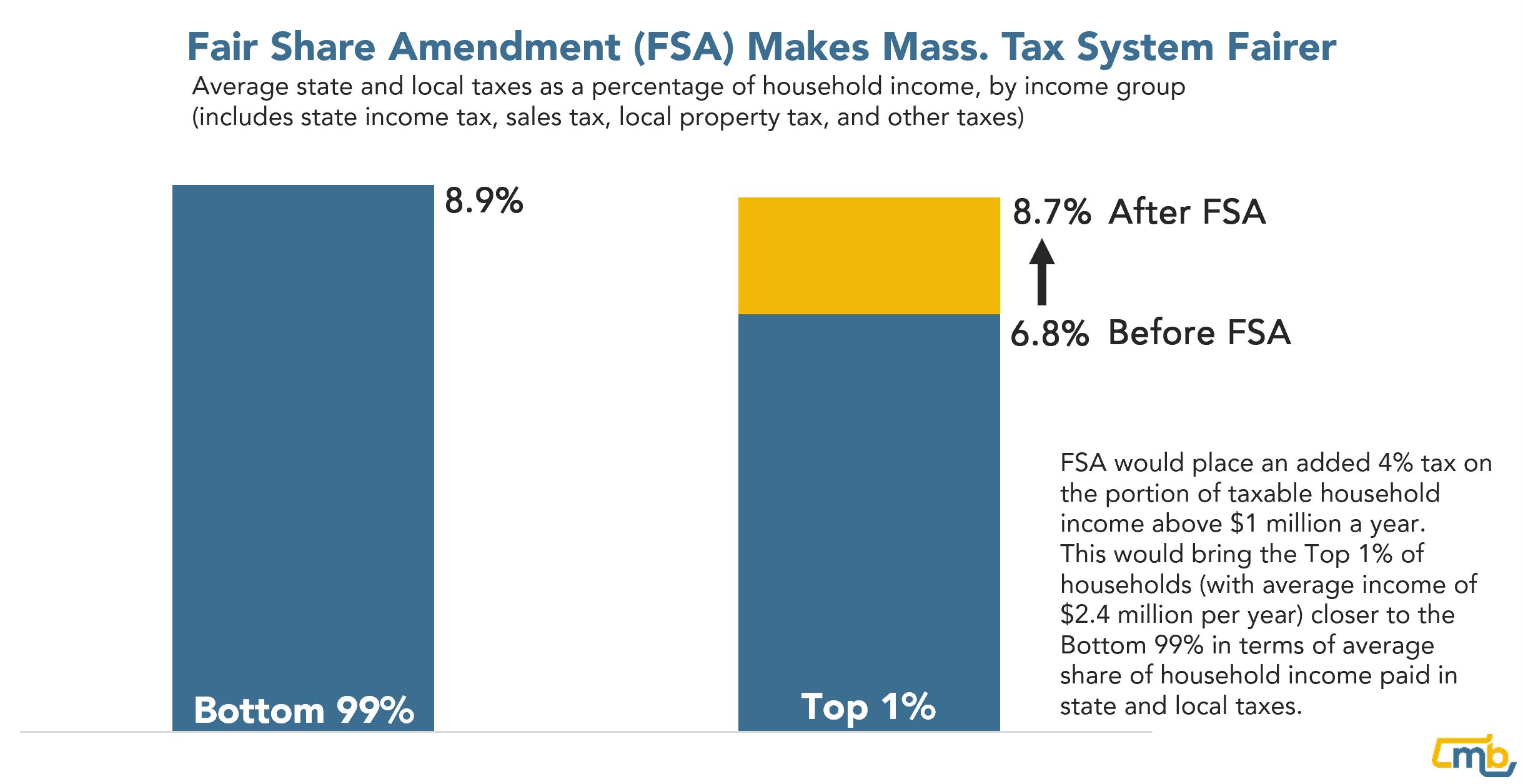

Millionaires Tax Debate Heats Up As Supporters Blast Opponents Fear Mongering Tv Ad The Boston Globe

February Mass Home Sales Hit 17 Year High Wbur News

Here S What You Can And Can T Buy Tax Free In Mass This Weekend Wbur News

Learn More About The Massachusetts State Tax Rate H R Block

Millionaire Tax Would Make Massachusetts Tax System Fairer Mass Budget And Policy Center

In 2009 Amid Recession Massachusetts Raised Its Sales Tax Rate Could That Fly Now Archives Berkshireeagle Com

Is Shipping Taxable In Massachusetts Taxjar

Download Instructions For Form St Mab 4 Sales Tax On Meals Prepared Food And All Beverages Return Pdf Templateroller

How To File And Pay Sales Tax In Massachusetts Taxvalet

Is Food Taxable In Massachusetts Taxjar

Massachusetts Sales Tax Guide For Businesses